Traditional roots, modern application

We’re staunch believers in the investment philosophy and mental models expounded by our role models Warren Buffet and Charlie Munger. Our aim is to generate long-term value for investors, maximizing gains and returns.

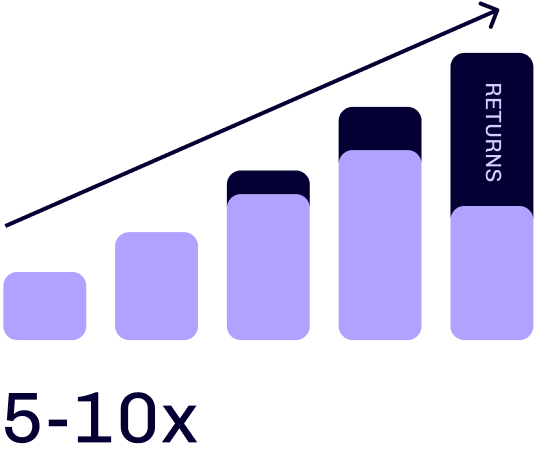

Why India

We study the understudied and appreciate the under-appreciated in order to carefully select the companies we invest in. With the third-largest billionaire pool and the fastest growing economy, the potential of India and Indian companies is still untapped.